Deloitte experts predict real estate market in Greece to grow

The latest report from Deloitte, one of the Big Four consulting companies, highlights Greece's improving economic conditions and residential property growth. Greece continues to be one of the most affordable property markets in the EU, with residential property prices starting at €1,463 per square metre - only Bosnia and Herzegovina offers lower prices.

Low prices, strong competition, recovering economy

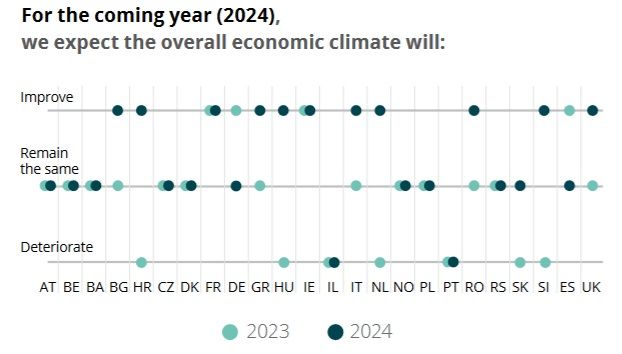

Housing prices have remained relatively low due to a combination of strong market competition and a moderate economic recovery. However, the market is showing positive momentum. This is mainly driven by foreign investment and a robust tourism sector. This trend is a sign that property values are likely to be on the rise.

Housing and the economy: close and interlinked. In the EU, housing is closely linked to economic indicators. Growing GDP typically supports rising property prices. In addition, interest rates play a crucial role. Higher interest rates make mortgages more expensive and dampen housing demand. While falling rates could support property values, experts warn that rates are unlikely to return to pre-crisis lows soon. This means that prices are unlikely to fall significantly, although housing may become more accessible.

So what's going to happen?

Deloitte's 13th Real Estate Index provides valuable insights into the European market, with a particular focus on Greece. It is based on data up to 2023. Some of the key findings highlight:

A rise in foreign investment: A steady influx of international buyers is boosting demand for residential property. This is particularly true in urban areas and tourist centres.

The impact of tourism: Greek tourism is recovering strongly, boosting demand for rental property.

Future pricing: Housing remains affordable compared to other EU countries. However, prices are expected to rise steadily due to increased demand and economic recovery.

Read the full analysis for an in-depth look at how the Greek property market is evolving and what opportunities are ahead for investors.

European real estate market: key trends

According to experts, the European residential property market is now being shaped by several key trends.

Digital transformation

Real estate is becoming increasingly digital, making transactions faster and more transparent. Buyers can now sign contracts online. Many are willing to commit to a purchase based on virtual tours alone.Growth in Build-to-Rent (BTR)

The rental market remains popular with investors. It offers stable, long-term returns. The demand for rental properties is particularly strong among young professionals and people living in urban areas. Developers and refurbishment projects are adapting to their needs, creating modern complexes with community-centric amenities.Increasing Caution Amid Economic Uncertainty

High interest rates and inflation have had a dampening effect on demand, particularly among first-time buyers. This caution may help to stabilise the market, making conditions more predictable for those wishing to invest and buy.Sustainability and Energy Efficiency

Despite these challenges, sustainability remains a top priority. Buyers and investors increasingly seek energy-efficient properties, while new legislation drives the adoption of green technologies. Focusing on green solutions helps to add value over the long term.The affordable housing gap

The shortage of affordable housing is forcing governments to explore innovative ways to build and regulate the rental market to help ensure a steady supply. As part of these measures, stricter rental regulations are becoming increasingly common.

We've previously covered how Greece is addressing this issue and how investors can navigate the changing landscape of the rental market.

Make sure you stay informed to make the most of these changes.

The bottomline: the market is uncertain but remains resilient and adaptive.

European rental market highlights

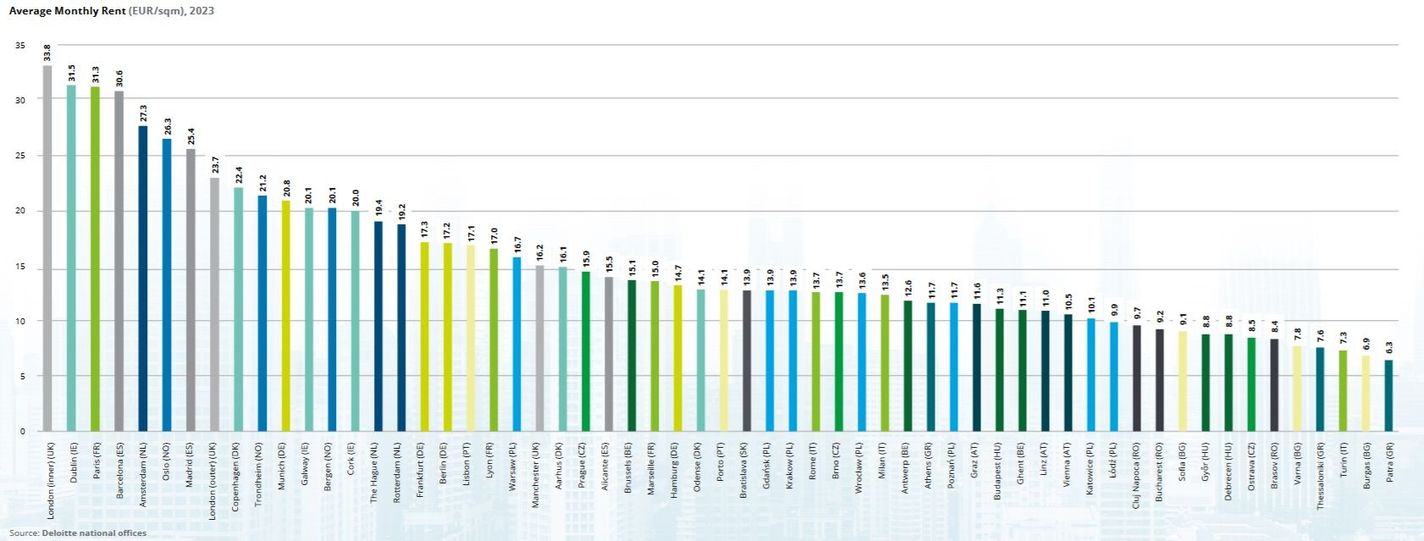

Most expensive cities to rent in 2023:

London (central) takes the lead with an average rental rate of €33.8/m².

Dublin (€31.5/m²) and Paris (€31.3/m²) are also in the top tier.

Athens isin the middle with an average price of €11.7/sqm.

Barcelona, Amsterdam, Oslo, Madrid, Munich, Copenhagen and the suburbs of London are also among the cities with high rental prices.

Cheapest cities to rent:

Patras (€6.3/m²), Burgas (€6.9/m²), and Turin (€7.3/m²) are the most budget-friendly.

Other affordable cities include Thessaloniki, Varna, Brașov, and Ostrava, where rental costs are below €9/m².

Cities with significant rental price increases:

Manchester: +51.4%

Porto: +35.6%

London (central): +27.3%

Lisbon: +24.8%

London suburbs: +21.3%

Cities with declining rental prices:

Lyon: -10.5%

Oslo: -6.1%

Trondheim: -6.0%

These figures demonstrate the diversity of the European rental market. It offers opportunities for both premium and budget investment strategies.

Athens rental market growth:

Athens saw a 7.1% increase in rental prices in Q3 2024.

The most expensive areas were:

Vouliagmeni: €20/m²

Kolonaki: €16.7/m²

Glyfada: €16.5/m²

Paleo Psychiko: €16/m²

Voula: €15.7/m²

The European rental market remains dynamic, with both high quality and affordable opportunities for investors and renters.

The Real Estate Market in Greece: Current Trends and Forecasts

2023 saw the real estate market experiencing high demand from both local and international buyers, particularly for the luxury housing segment. Property prices and investment activity continued to rise despite geopolitical uncertainties and high inflation.

The residential sector proved to be the most attractive, especially properties with strong investment potential. This led to significant price increases for apartments. Major cities such as Thessaloniki (16.2%) and Athens (13.7%) recorded the highest growth rates.

Today, a new home in Greece, comparable to countries such as Poland, Bosnia and Herzegovina, the Netherlands, the UK and Slovenia, typically costs between 6 and 8 years of average salary.

Key drivers of housing demand

High level of interest among foreign investors

Limited luxury housing supply

Positive trends in the tourism sector

Short-term rental popularity

Additionally, subsidized housing programs for young buyers have strengthened the market, contributing to overall price increases. Investment in residential real estate grew by 20.7%, although its share in GDP remains low (1.9%).

Factors supporting market growth

Economic recovery and improving infrastructure

Athens as an attractive tourist destination and its impact on real estate

The role of the Golden Visa programme in stimulating demand for real estate

The market's long-term growth potential is underlined by positive construction forecasts and an 18.1% increase in interest in new projects in 2023. Strong demand from foreign investors, especially in the luxury segment, combined with limited supply, continues to push prices up. The Golden Visa programme remains a key driver of capital inflows.

The outlook

With strong price growth, active investor interest and support from the booming tourism sector, the property market in Greece is on an upward trajectory. Athens, the main centre of demand, continues to show steady growth in both selling and renting. However, future market growth depends on its ability to meet rising demand through increased supply and investment infrastructure.